Pickering, Clarington to benefit from nuclear’s addition to Ontario green bond eligibility

Published February 7, 2024 at 3:28 pm

Recognition for the environmental benefits of nuclear power as Canada moves to bump up production of clean and green energy sources to reach climate change goals has been welcomed by the industry.

Also welcomed is recognition that is felt in the wallet, such as the Province’s recent announcement last that emissions-free nuclear energy is now eligible for Ontario’s Sustainable Bond Framework.

The new framework, replacing the Green Bond Framework from 2014, allows the Province to issue green bonds for projects that provide environmental benefits to Ontario.

Ontario Finance Minister Peter Bethlenfalvy, who is also the Pickering-Uxbridge MPP, called it “great news” for Ontario residents. “It’s part of our plan to have the cleanest power grid in North America,” he said.

Ontario Finance Minister Peter Bethlenfalvy

Canadians for Nuclear Energy, a grassroots organization that has been championing nuclear’s return to public favour in recent years, was also on board with the news.

“Nuclear is in the Ontario Bonds!” Canadians for Nuclear Energy President Chris Keefer said on X (formerly Twitter). “It’s great to see Canada’s nuclear-powered province aligning with the feds, the EU, South Korea and the U.K. in including nuclear within their Green Bond frameworks.”

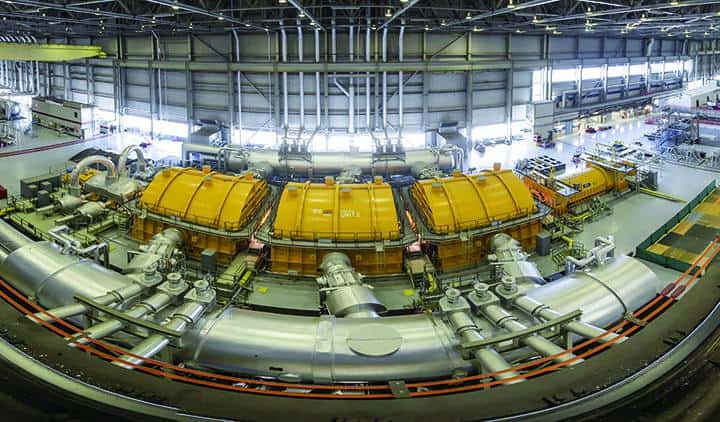

Last year, the federal government introduced a range of tax credits in the spring budget that can be applied to nuclear power – including a 15 per cent refundable investment tax credit that can be applied for new refurbishments and even OPG’s 300-megawatt Small Modular Reactor (SMR) being built at the Darlington Nuclear plant.

Canadian Nuclear Association President John Gorman called it proof of Ottawa’s “clear and strong support” for nuclear energy playing an “indispensable role” in the country’s clean energy future.

Nuclear being made eligible for a range of other tax incentives help level the playing field for clean energy technologies and enables nuclear to compete fairly with other non-emitting sources of power, he added.

The 2023 budget also contained a 30 per cent investment tax credit for manufacturing of clean technologies and the extraction, processing, or recycling of critical minerals. This new credit includes manufacturing of nuclear energy equipment and processing or recycling of nuclear fuels.

For more information on the Provincial Sustainable Bonds Framework visit https://ofina.on.ca.

Editor’s note: A previous version of this article misidentified Canadians for Nuclear Energy President Chris Keefer as the president of Environmental Defence. We regret the error.

INdurham's Editorial Standards and Policies