Production of internal combustion GM trucks in Oshawa and elsewhere could add billions in annual profit

Published June 20, 2023 at 3:22 pm

A flurry of General Motors funding announcements in recent weeks – including a $280 million investment into the Oshawa Assembly plant – is a sign the company plans to keep its largest and most profitable combustion trucks and SUVs in production a decade or so longer than analysts expected.

The move to invest in production of internal combustion trucks and SUVs will also likely line GM’s pockets to the tune of $50 billion in profits over the next dozen years.

General Motors is mandated to switch to an all-electric fleet by 2035.

GM, in declaring in 2021 it would switch to zero-emission vehicle production by 2035, never actually said when they would stop production of traditionally powered vehicles, and the recent announcements should be good news for Unifor, which expects to begin talks on a new labour deal with the Big Three later this summer with the future of internal vehicle-related jobs a key concern.

“It is important there is stability for our Local 222 members going forward,” said Jason Gale, Unifor GM Master Bargaining Chair. “Unifor fought long and hard to secure these jobs for Oshawa, as we’ve seen the plant return from the closure of vehicle assembly to a three-shift assembly operation today.”

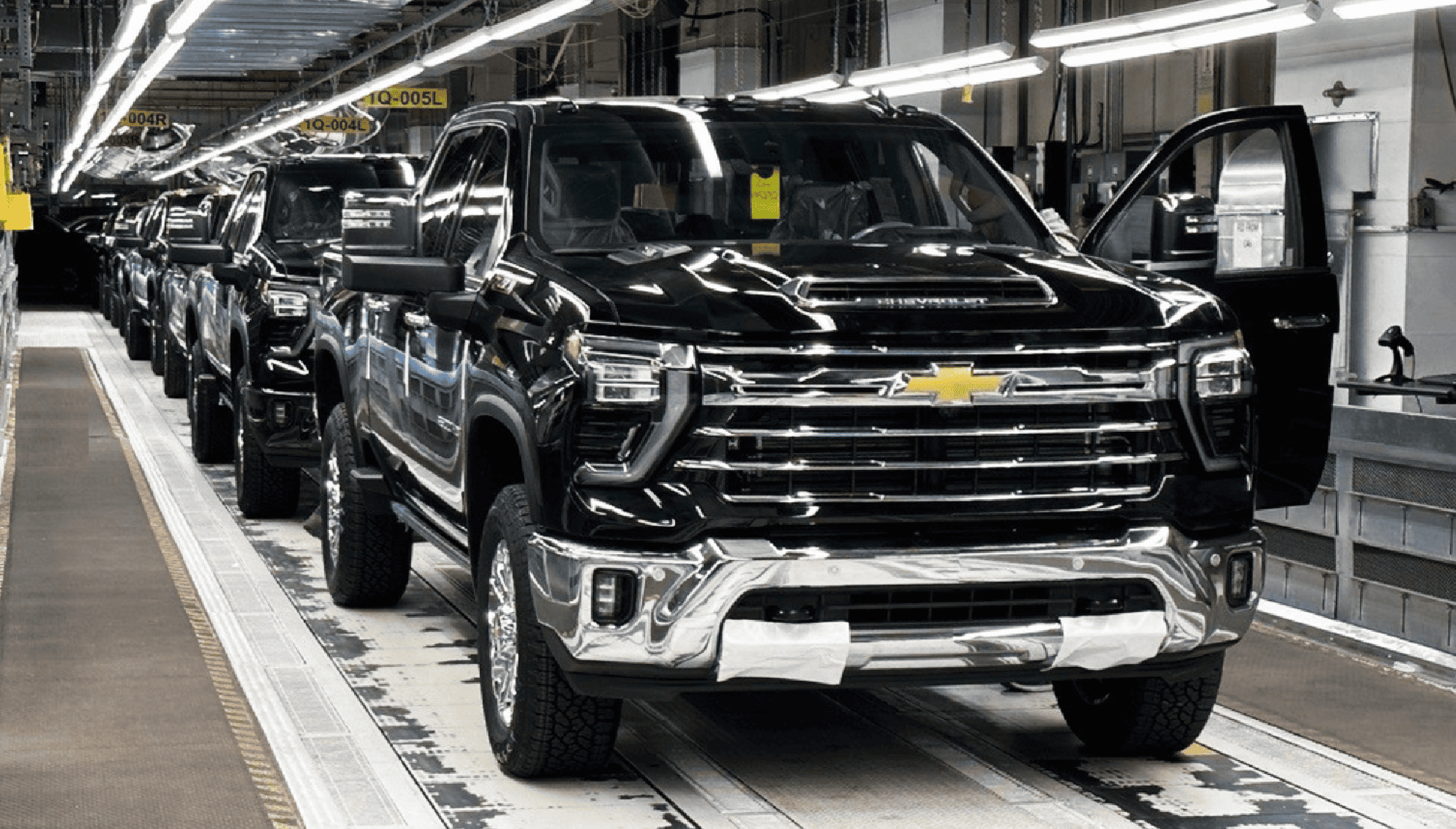

The Oshawa Assembly plant is GM’s only truck plant capable of producing the heavy-duty Silverado HD and light-duty Silverado 1500 on the same production line.

“Our members stand ready to build the next generation of trucks and the generation beyond that,” added Unifor national President Lana Payne. “The success of the Oshawa-made Silverado trucks is helping fund GM’s EV investments. As the transition continues our members expect to share in the EV future.”

GM executives have acknowledged it could be years before electric vehicles begin to match the profit from internal combustion vehicles like the Silverado trucks and SUVs.

Last year, GM’s average per-vehicle earnings before interest and taxes on all of its trucks and SUVs was $10,678, as calculated by Benchmark auto analyst Michael Ward, based on GM’s SEC filings.

Those numbers translate to as much as $7.5 billion a year in pretax profit on its full-size combustion trucks and SUVs, based on AutoForecast Solutions’ estimates for production at the Flint, Fort Wayne, Arlington and Oshawa plants through 2035.

Flint and Oshawa are expected to build a combined 360,000 heavy-duty pickups a year through 2035, which could generate $3.8 billion a year in pre-tax profit between them.

With files from Reuters

INdurham's Editorial Standards and Policies