Whitby, Uxbridge, Pickering with some of the highest property taxes in GTA – Oshawa with top mill rate

Published May 29, 2023 at 3:29 pm

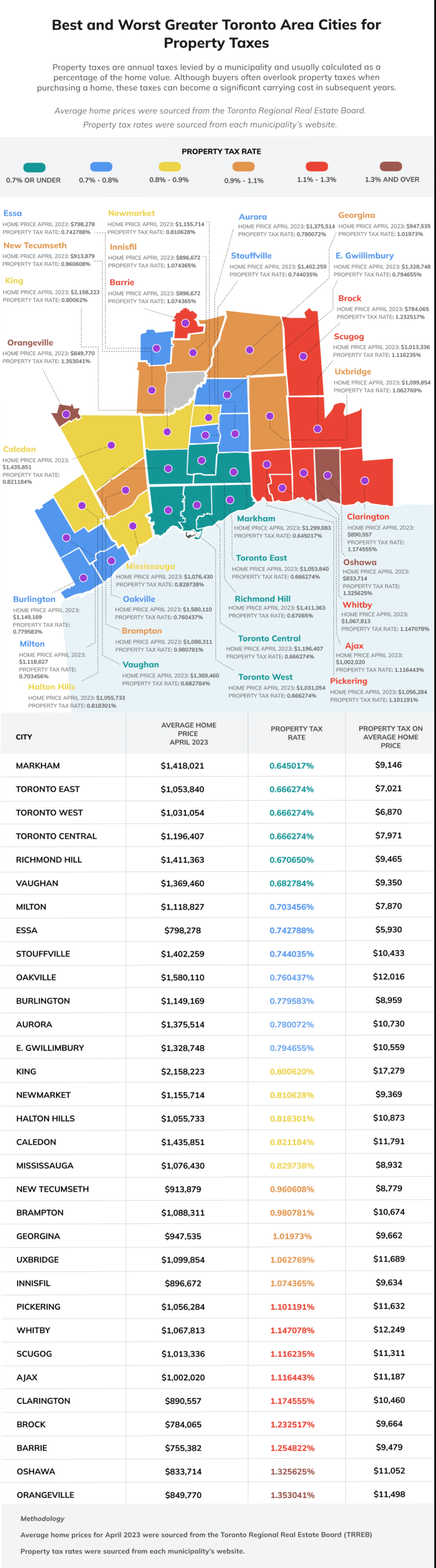

Despite having housing prices below most of their Golden Horseshoe neighbours, Oshawa’s property tax rate mill rate is the highest in the entire GTA and trails only Orangeville for the top spot in southern Ontario.

In general, municipalities with higher average home prices have lower property tax rates, while, conversely, municipalities with more affordable average home prices have higher property tax rates. Oshawa, and Durham Region in general, bucks that trend.

Real estate brokerage Zoocasa looked at 32 Ontario communities and found that Oshawa’s mill rate of 1.325625 per cent is double that of Markham (.645017 per cent), which boasts the lowest property taxes in the GTA – and some of the most expensive homes as well. Coming in right behind Oshawa are Brock Township (1.232517 per cent) and Clarington (1.174555 per cent), with every municipality in Durham having a mill rate greater than one per cent.

The high taxes in Durham are somewhat mitigated by the relatively low average housing prices, though Whitby, with a mill rate of 1.147078 per cent and average house prices of $1,067,813, has the second highest average property taxes among the 32 communities surveyed at $12,249, trailing only King Township at a whopping $17,279 on average home prices of $2,158,223.

Residents in each of Durham’s eight communities pay more in taxes than the average homeowner in Toronto (as low as $6,870) or Mississauga ($8,932).

The average property tax bills in the rest of Durham Region are:

- Uxbridge $11,689

- Pickering $11,632

- Scugog $11,311

- Ajax $11,187

- Clarington $10,640 and

- Brock $9,664